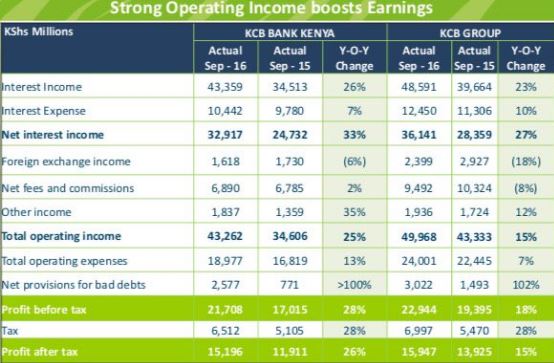

NAIROBI, Kenya, Nov 8 – Kenya Commercial Bank’s net interest income grew by 33 percent to push the bank’s total income to nearly Sh50 billion in the third quarter of 2016.

KCB Group announced a net profit of Sh15.9 billion on the back of a strong demand for loans in its Kenya operations.

Net loans and advances went up by 5 percent to 364 billion.

At the same time, the bank brought down NonPerforming Loans by Sh1.9 billion in the year under review as result of enhanced credit processes and recoveries.

However, total expenses went up 7 percent from Sh22.4 billion to Sh24 billion on investment in channels and infrastructure.

In a trend that is now spreading across the financial sector, the number of mobile loans KCB has issued now stands at 10 million, a 98 percent growth from 4 million in quarter 3, 2015.

Registered customers on mobile account for 75 percent of total customer base in the bank, within one year.

“The bank will focus more on technology to drive future business. The uptake of non branch channels has contributed 73 percent of total bank transactions,” said Joshua Oigara, KCB CEO.

91 percent of the bank’s total loans are now processed via mobile.

In light of this uptake , Oigara said KCB will launch a FinTech business arm to complement traditional banking and centralize digital platform.